Charting the Course: Opportunities for Debt Card Access After Bankruptcy Discharge

Navigating the globe of charge card access post-bankruptcy discharge can be an overwhelming task for people aiming to rebuild their monetary standing. The process involves critical preparation, comprehending credit rating rating details, and discovering various options available to those in this certain scenario. From secured credit history cards as a stepping rock to potential courses leading to unprotected credit history possibilities, the trip towards re-establishing creditworthiness calls for cautious factor to consider and notified decision-making. Join us as we check out the methods and techniques that can lead the way for individuals seeking to reclaim accessibility to bank card after facing bankruptcy discharge.

Recognizing Credit History Basics

A credit rating score is a numerical depiction of an individual's creditworthiness, indicating to lending institutions the degree of risk linked with expanding credit score. Several aspects contribute to the computation of a credit scores rating, consisting of repayment history, amounts owed, length of credit score history, brand-new credit report, and types of credit report made use of. The quantity owed family member to readily available credit history, also known as credit score usage, is another important factor influencing credit scores.

Secured Credit Report Cards Explained

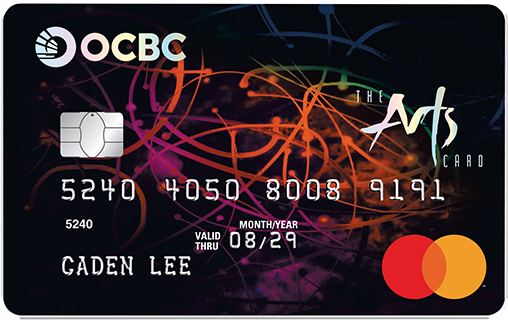

Safe charge card provide a useful economic device for people wanting to rebuild their credit report adhering to an insolvency discharge. These cards need a down payment, which typically determines the credit line. By making use of a safeguarded charge card properly, cardholders can show their creditworthiness to prospective lending institutions and progressively enhance their credit report.

Among the vital benefits of secured debt cards is that they are more available to individuals with a limited credit score history or a damaged credit history - secured credit card singapore. Because the credit history limitation is protected by a down payment, issuers are much more ready to accept applicants that might not get conventional unsecured debt cards

Charge Card Options for Reconstructing

When seeking to rebuild credit history after insolvency, discovering different credit history card options customized to people in this economic circumstance can be beneficial. Guaranteed credit scores cards are a preferred option for those looking to rebuild their credit. One more choice is ending up being an authorized user on a person else's credit card, enabling people to piggyback off their credit rating history and possibly enhance their very own rating.

How to Get Unsecured Cards

Keeping an eye on credit report records frequently for any kind of errors and disputing mistakes can better improve credit report scores, making individuals a lot more attractive to credit rating card issuers. Furthermore, people can consider using for a safeguarded credit rating card to rebuild credit score. Secured credit score cards need a cash money down payment as security, which reduces the threat for the issuer and permits people to show liable credit card usage.

Tips for Liable Credit Rating Card Use

Structure on the structure of improved credit reliability developed via accountable financial management, individuals can enhance their total monetary well-being by executing key tips for accountable charge card usage. Firstly, it is vital to pay the complete declaration balance in a timely manner every month to avoid building up high-interest costs. Establishing up automatic payments or tips can help guarantee timely settlements. Secondly, keeping an eye on costs by on a regular basis monitoring credit rating card statements can stop overspending and help determine find more information any type of unauthorized transactions without delay. Furthermore, preserving a reduced credit history usage ratio, preferably listed below 30%, demonstrates accountable credit history usage and can favorably affect credit rating. Preventing cash loan, which typically come with high charges and interest prices, is also a good idea. Last but not least, avoiding opening several new bank card accounts within a brief period can stop possible credit scores score damages and too much financial debt accumulation. By sticking to these tips, individuals can utilize credit cards properly to restore their monetary standing post-bankruptcy.

Verdict

Finally, individuals that have filed for personal bankruptcy can still access credit report cards via various options such as safeguarded debt cards and rebuilding credit score (secured credit card singapore). By recognizing credit rating score fundamentals, receiving unsecured cards, and practicing liable charge card use, people can progressively restore their credit reliability. It is very important for people to carefully consider their economic situation and make notified choices to enhance their credit rating standing after insolvency discharge

A number of variables add to the estimation of a credit rating score, including payment history, amounts owed, size of credit scores history, brand-new debt, and types of credit history made use of. The quantity owed family member to offered credit history, likewise understood as credit visit this website score usage, is another important factor affecting credit rating scores. Keeping an eye on debt reports frequently for any type of errors and challenging errors can additionally enhance credit rating ratings, making people more eye-catching like it to credit rating card providers. In addition, preserving a reduced debt use ratio, preferably listed below 30%, shows accountable credit history usage and can favorably impact debt scores.In final thought, individuals who have actually submitted for insolvency can still access debt cards with different choices such as protected credit report cards and reconstructing credit scores.